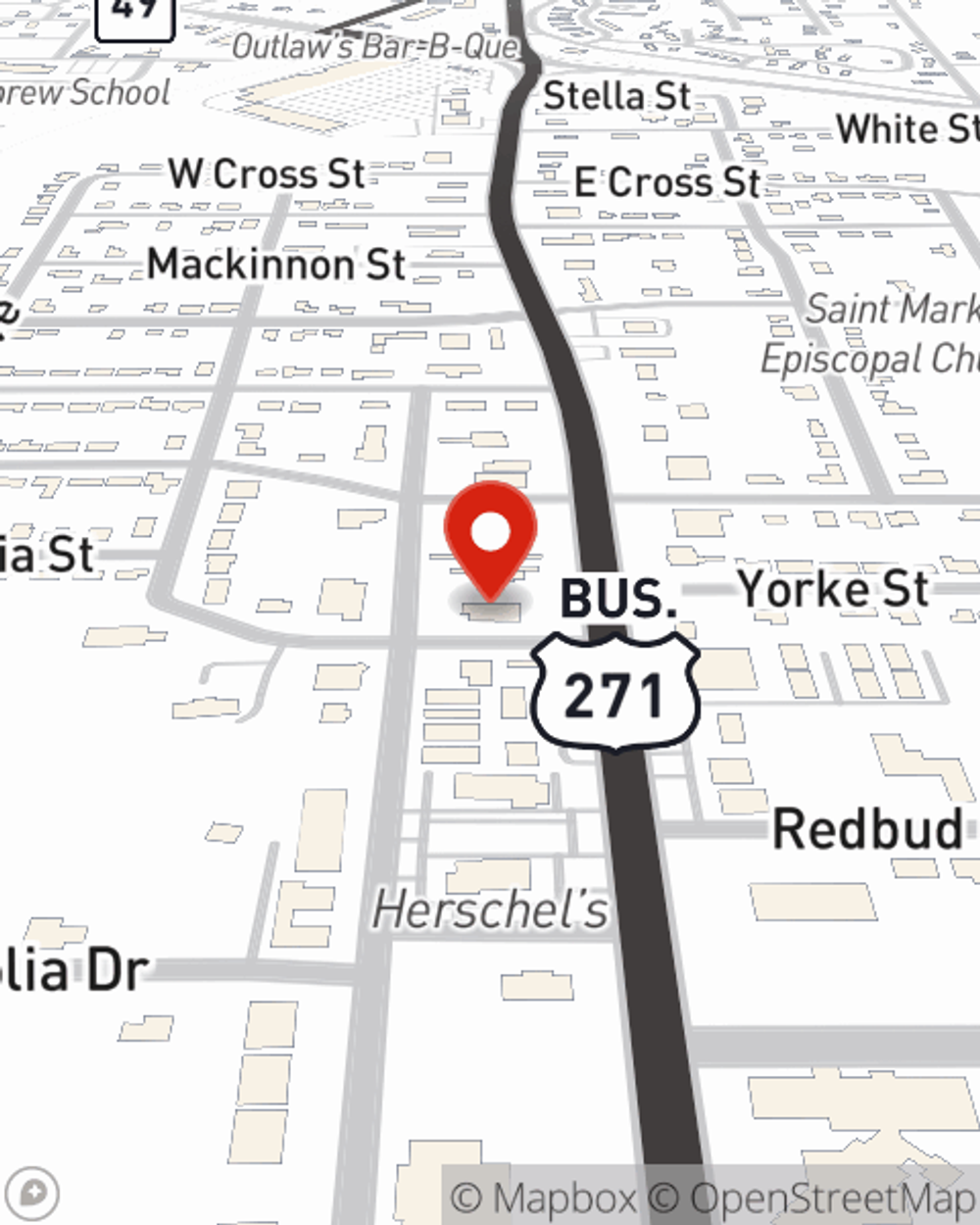

Renters Insurance in and around Mt Pleasant

Looking for renters insurance in Mt Pleasant?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Daingerfield

- Hughes Springs

- Mount Vernon

- Omaha

- Naples

- Pittsburg

- Winfield

- Lone Star

- Gilmer

- Cookville

- Talco

- Bogata

- Leesburg

- Saltillo

- Scroggins

- Winnsboro

- Titus County

- Morris County

- Camp County

- Cass County

- Franklin County

- Wood County

Home Is Where Your Heart Is

Even when you rent a place to live you still have plenty of responsibility. You want to make sure what you own is protected in the event of some unexpected mishap or damage. And you also need liability protection for friends or visitors who might become injured on your property. State Farm Agent Bo Rester is ready to help you navigate life’s troubles with reliable coverage for your renters insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Bo Rester can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Looking for renters insurance in Mt Pleasant?

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

When the unpredicted tornado happens to your rented townhome or space, usually it affects your personal belongings, such as a stereo, a cooking set or a set of golf clubs. That's where your renters insurance comes in. State Farm agent Bo Rester can help you examine your needs so that you can protect your belongings.

Contact State Farm Agent Bo Rester today to explore how the trusted name for renters insurance can protect your possessions here in Mt Pleasant, TX.

Have More Questions About Renters Insurance?

Call Bo at (903) 572-9999 or visit our FAQ page.

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.